Vanda Research

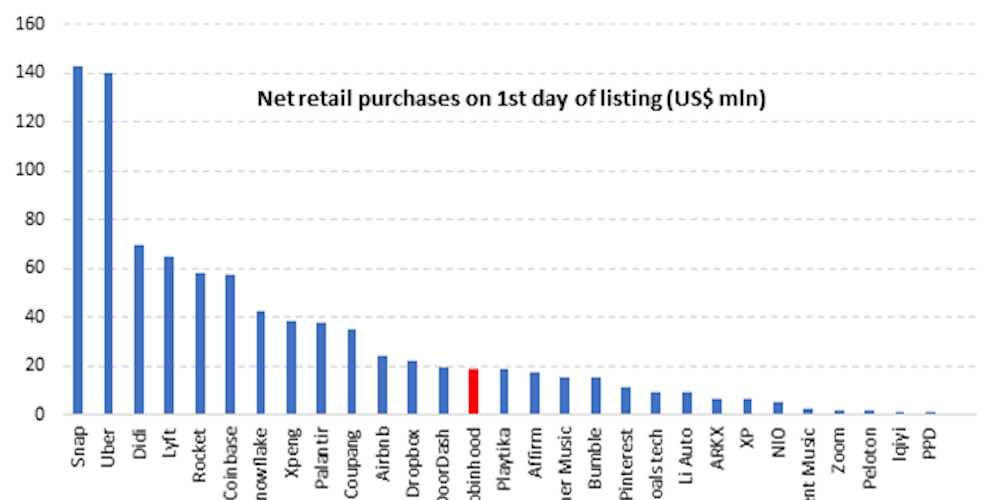

- Individual investors bought $18.85 million in shares of Robinhood during the trading app's debut on Thursday, Vanda Research said.

- That's lower than other major IPO debuts, including this year's launch of Coinbase.

- Robinhood ended its first trading session down by 8.4% and has continued its slide on Friday.

- See more stories on Insider's business page.

Retail investors bought $18.85 million of Robinhood stock during the trading app's first day in the public market, lower than other major IPO debuts, according to Vanda Research data released Friday.

Retail investors poured more money into this year's launches of crypto exchange Coinbase and Chinese ride-hailing app Didi Global. In April, $57.4 million in Coinbase stock was purchased, and in June, that group picked up $69.8 million in Didi stock, said Vanda, whose VandaTrack arm watches activity in 9,000 individual stocks and ETFs in the US.

The $19.7 million of DoorDash shares purchased in the food delivery company's December 2020 debut was just ahead of retail purchases of Robinhood stock.

Robinhood shares had a rough first session on Thursday, dropping 8.4% to end at $34.82 after being whipsawed. The IPO price of $38 was at the low end of its targeted range of $38 to $42 per share.

Social media app Snap tops the list at $143 million in shares purchased by retail investors, said Vanda. Snap went public in March 2017. Uber was right behind that, at $139.9 million in May 2019 for the ride-hailing app.

Robinhood bucked convention in its IPO by setting aside 35% of its shares for individual investors. The company earlier this year angered many of its customers when it halted buying of GameStop, AMC Entertainment and other meme stocks during a massive rally. Robinhood had pledged to earn back the trust of those customers. The company has more than 18 million accounts and 17.7 million active monthly users.

Among institutional investors, Cathie Wood's ARK Innovation ETF exchange-traded fund bought nearly 1.3 million shares of Robinhood on Thursday, according to a daily trading report from Ark Investment Management. That logs a $45 million stake in Robinhood at the company's closing price.